Intel (NASDAQ:INTC) shares have recorded a gradual recovery following the previous quarter’s shock announcement of a delay in the launch of the 7nm node products. As an illustration, after hitting a low of $47.73 on the 31st of July, the stock has rebounded, registering a gain of over 12 percent in the process. Today, the semiconductor behemoth is again in the spotlight as it gears up to announce its earnings for the third quarter of 2020.

The company reported its much-anticipated scorecard just moments ago, barely exceeding expectations when it comes to revenue and the EPS.

Intel (NASDAQ: INTC) Financial Scorecard

For the three months that ended on the 30th of September 2020, Intel reported $18.3 billion in revenue, registering a decrease of 4.7 percent relative to the comparable quarter last year.

<!—->

(All figures are in billions of dollars)

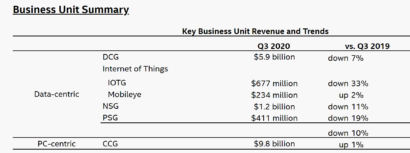

As far as Intel’s business segments are concerned, Mobileye led the pack with 2 percent annual growth:

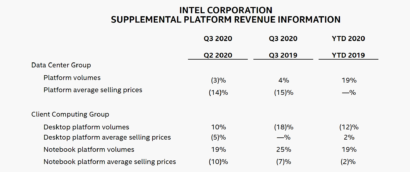

The following excerpt from Intel’s earnings release provides supplemental platform revenue information:

Intel’s other key metrics are as follows:

<!—->

(All figures are in billions of dollars; operating cash flow is based on year-to-date numbers)

Finally, Intel earned $1.11 in EPS (non-GAAP), beating consensus expectations by a razor-thin margin.

<!—->

(All figures are in dollars)

As far as the guidance for Q4 2020 is concerned, Intel expects to earn a revenue of $17.4 billion. Moreover, Intel expects its operating margin to compute at 24.5 percent (on GAAP basis) during the fourth quarter. For the entire FY 2020, the company expects to earn a revenue of $75.3 billion and its operating margin to compute at 29.5 percent (GAAP).

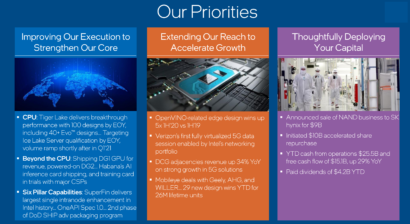

As far as Intel’s product line is concerned, the company noted:

“Intel’s third 10nm manufacturing facility, which is located in Arizona, is now fully operational and the company now expects to ship 30% higher 10nm product volumes in 2020 compared to January expectations.”

Source

The market has reacted negatively to Intel’s financial reporting with the stock posting a loss of over 10 percent in the after-hours trading mainly due to muted guidance and the company halting its massive share buyback program.

Source

We noted in the beginning of this article that Intel shares have recovered from their recent July lows. Going further, the company’s mammoth share buyback program may have played an important role in providing this boost. As an illustration, on the 19th of August, Intel entered into accelerated share repurchase agreements for $10 billion of its common stock. This latest tranche of buybacks is a part of a $20 billion program that Intel announced last October but was suspended in March 2020 following the onset of the coronavirus (COVID-19) pandemic. For now, however, it appears that Intel is pausing this program until markets stabilize:

“In August, Intel initiated accelerated share repurchase (ASR) agreements for an aggregate of $10.0 billion of our common stock. Following settlement of these agreements, Intel will have repurchased a total of approximately $17.6 billion in shares as part of the planned $20.0 billion share repurchases announced in October 2019. Intel intends to complete the $2.4 billion balance and return to historical capital return practices when markets stabilize.”

Of course, the star attraction during the quarter was the launch of the 11th generation Tiger Lake processors that feature the Iris Xe GPUs. Intel claims that these new processors are ideal for thin and light laptops, offering up to 2.7x faster content creation, over 20 percent faster office productivity, and over 2.0x faster gaming and streaming in “real-world workflows” over competing products.

Elsewhere, the global pandemic-induced economic slowdown continues to pose headwinds for Intel’s Internet of Things Group (IOTG) and Mobileye division. Nonetheless, Mobileye continues its relentless march ahead, having secured a contract with UAE’s Al Habtoor Group in September for the deployment of a robo-taxi fleet in the Emirates by the end of 2022. Bear in mind that the division already has agreements to deploy its autonomous vehicle technology in cities across France, Israel, Japan, and South Korea.

Moreover, given the ongoing online learning and WFH trends, the Client Computing Group continues to benefit from an increase in PC shipments. According to the latest IDC data, PC shipments in the third quarter increased 14.6 percent year-over-year to 81.3 million units.

Intel’s data-centric revenue has been a disappointment this quarter though as the company noted in its earnings release:

“Data-centric revenue* declined 10 percent while PC-centric revenue was better than expected, up 1 percent YoY.”

Finally, as per our reporting this week, Intel is selling its memory unit business to SK Hynix for $9 billion. Specifically, the deal will include NAND SSD, NAND component and wafer business as well as Intel’s 3D NAND plant in China. Commenting on the significance of this development, we had noted at the time:

“By offloading its memory division, Intel will have gotten rid of a division that has struggled to improve its profits and margins. Dropping memory prices have made it difficult for Intel to maintain comfortable margins for its products …”

More Stories

AMD Radeon RX 6800 XT “Big Navi” GPU Alleged 3DMark Benchmarks Leaked – Faster Than GeForce RTX 3080 at 4K, Slower In Port Royal Ray Tracing

AMD Ryzen 7 5800H 8 Core & 16 Thread Cezanne ‘Zen 3’ High-Performance CPU Shows Up, Early ES Chip With 3.2 GHz Clocks

BitFenix Announces Two New Cases, The Nova Mesh SE and the Nova Mesh SE TG